The national budget is usually a time for finance ministers to show off their number-crunching skills and assure us that everything is under control (even when it’s not). But this year’s budget drama turned into a full-blown political showdown, with the ANC reportedly threatening to push through a 0.75% point VAT increase—without its biggest Government of National Unity (GNU) partner, the DA. Instead, it may turn to the Economic Freedom Fighters (EFF) to get the job done.

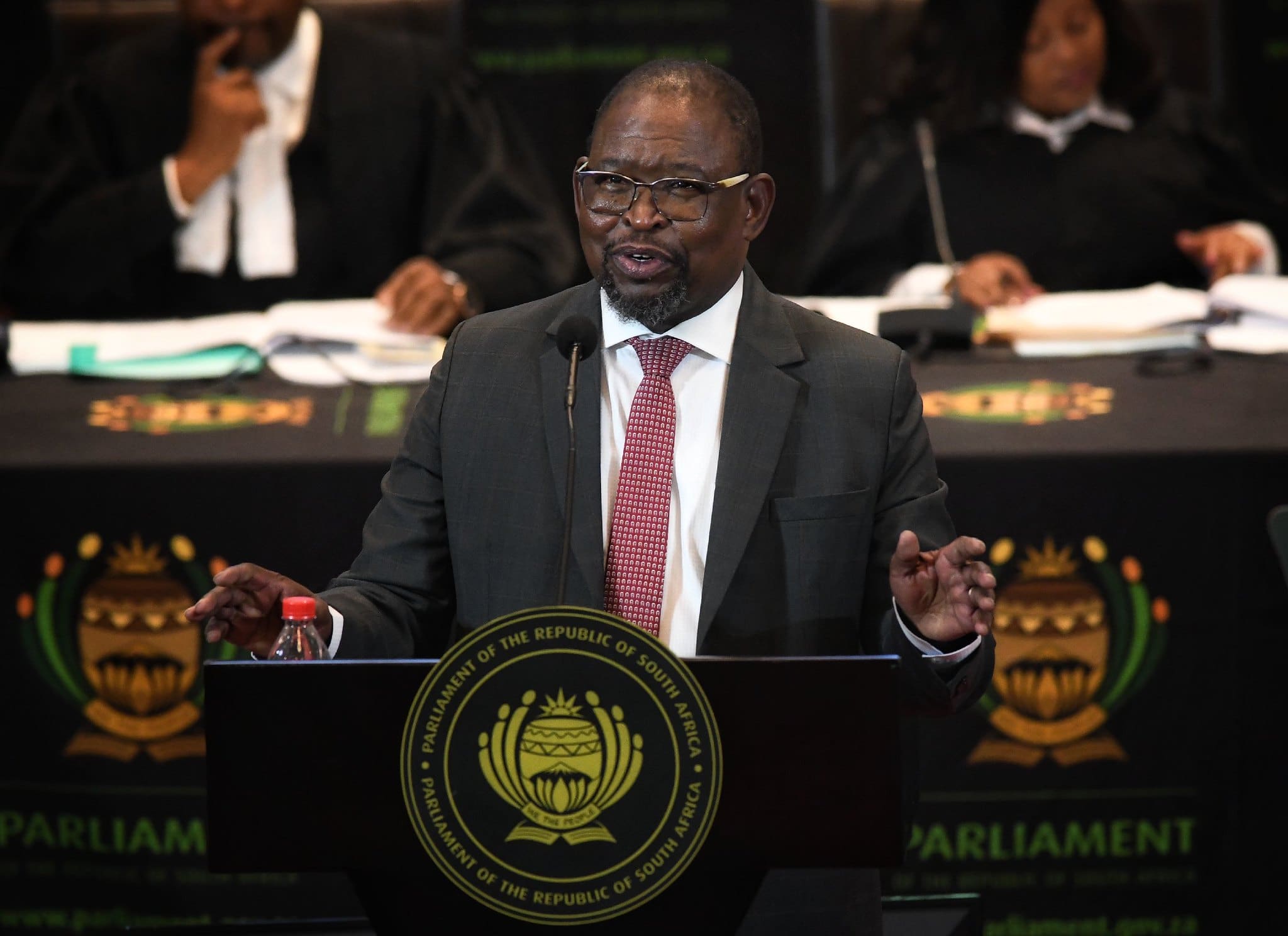

Meanwhile, the EFF denies it’s even in talks with the ANC on this matter. So, what’s really going on? After some back-and-forth over proposed VAT hikes, Cabinet has finally reached a decision on the 2025 national budget. In a special meeting on 3 March, Cabinet gave Finance Minister Enoch Godongwana the go-ahead to choose from a set of options for the budget. These options are meant to balance fiscal constraints, protect the poor, and support economic growth.

With the cabinet’s input done, the budget will now be tabled in Parliament on 12 March.

How did we get here? Why is the VAT increase on the table?

Finance Minister Godongwana was supposed to present the budget on 19 February, but that was derailed after the DA and other GNU members refused to back his plan for a two-percentage-point VAT hike, which would have taken VAT to 17%. The ANC has since softened its stance with a revised proposal of a 0.75% point increase instead. But the DA is still not biting.

John Steenhuisen, DA leader, has called the VAT hike a disaster in the making, saying it would “break the back of our economy.” The DA is pushing for alternative ways to plug the revenue gap, including:

- A 50% cut in government advertising budgets

- A 33% reduction in travel and catering expenses for government departments

- A hiring freeze on non-essential public sector positions for 12 months

- A national audit to eliminate ghost employees in the public sector

The DA also believes that improving tax compliance—from the current 63% to 67% — could generate an additional R60 billion in revenue. Selling underutilised state-owned land and properties could raise at least R10 billion, according to the party.

The ANC, on the other hand, insists that without a VAT hike, critical government programmes—including social grants and school nutrition schemes—will be in jeopardy. Treasury had earmarked an additional R35.2 billion for the COVID-19 Social Relief of Distress (SRD) grant and R23.3 billion for other social grants, all of which could be affected if the VAT increase is blocked.

To mitigate the impact of a VAT increase on low-income households, the ANC has pointed to the role of zero-rated goods. These are goods exempt from VAT, meaning they are taxed at a 0% rate. In South Africa, these include staple foods such as maize meal, brown bread, rice, milk, eggs, and vegetables.

The ANC has suggested that expanding the list of zero-rated goods could help cushion the impact of a VAT increase on vulnerable communities. However, critics argue that even with exemptions, a VAT increase will still raise the overall cost of living. The South African Federation of Trade Unions (SAFTU) contends that a VAT hike could trigger inflationary pressures, further eroding household incomes.

Enter the EFF… or not?

According to a Sunday Times report, the ANC warned the DA that if it refused to accept the revised VAT hike, it would look to the EFF for support. This would be a major shake-up in the GNU, where tensions are already high.

But EFF leader Julius Malema has denied any such talks are happening. “No one is talking to us,” Malema told reporters at his birthday celebrations in Tembisa on Monday. “We wanted them to present a budget, we said let there be a discussion and the people will decide if they want it or not.”

Despite Malema’s denial, the EFF’s stance on VAT is clear: it opposes any increase, arguing that South Africa should instead be maximising its mineral wealth to grow the economy and create jobs. “We have got a lot of minerals in this country which can be benefited from,” said Malema.

Can the GNU survive this?

The Government of National Unity was formed with the goal of fostering cooperation among political parties, yet this budget dispute reveals the fragility of that alliance. While the ANC holds the most seats, it lacks the outright majority needed to pass key legislation without the support of its coalition partners.

The ANC and DA are the two dominant parties within the GNU, securing approximately 40% and 21% of the vote, respectively, in last year’s general election. Steenhuisen, however, is not backing down. “If the EFF want to support a VAT increase that will hurt the poor, then they must explain it to their electorate,” he told the Sunday Times.

If the ANC moves forward with an EFF partnership to pass the VAT increase, it could destabilise the GNU, raising concerns about its long-term viability.

Beyond the political drama, the economic impact of a VAT hike could influence the stability of the GNU. Treasury data suggests that a 0.75 percentage point increase would generate around R30 billion in additional revenue. However, research from the Bureau for Economic Research (BER) warns that such an increase could push inflation up by 1% point, raising the cost of living and potentially leading to interest rate hikes by the South African Reserve Bank (SARB).

What happens next?

With the budget now set for 12 March, the next few days will be crucial.

A special cabinet meeting on Monday allowed Cabinet members to consider the variety of options to fund the 2025-2026 Budget, and Godongwana will now have the task of finalising and tabling the budget based on these inputs.

If the DA refuses to budge, will the ANC really turn to the EFF? And if it does, will the GNU survive?

Emma is a freshly graduated Journalist from Stellenbosch University, who also holds an Honours in history. She joined the explain team, eager to provide thorough and truthful information and connect with her generation.

- Emma Solomon

- Emma Solomon